What is the interoperability between ESG reporting standards?

An overview of the main initiatives developed to date to ensure interoperability between different ESG reporting standards

ESRS standards, GRI standards, IFRS standards... The coexistence of different non-financial reporting frameworks at the international and European level raises the fundamental question of their interoperability. This is indeed crucial to simplify the task for companies and aim for greater efficiency in the establishment of sustainability reports. Let's take stock.

Interoperability between ESG reporting standards: what are the issues?

In terms of ESG reporting, interoperability refers to the ability of different standards and reporting systems to work in conjunction with one another.

It thus aims to ensure a harmonization between these different frameworks to facilitate the reporting process for companies, especially for those that choose to comply with several standards, whether mandatory or voluntary.

💡Note: The concept of interoperability should be distinguished from that of compatibility, which simply means that two standards can be used jointly without risk of contradiction. On the contrary, interoperability between two standards means that compliance with one also guarantees compliance with the other (or at least with some of its requirements).

This convergence of ESG standards plays a crucial role in a context where we see a multiplication of normative frameworks internationally. Among the main existing reporting systems are:

- The ESRS standards of the EFRAG (European Financial Reporting Advisory Group)

- The GRI standards (Global Reporting Initiative)

- The IFRS-S standards of the ISSB (International Sustainability Standards Board)

- The CDP questionnaire (Carbon Disclosure Project)

While we should obviously welcome this plethora of initiatives in the field of ESG reporting, it nonetheless results in a fragmented normative landscape and a lack of clarity for companies, which interoperability should address.

What are the advantages of interoperability for companies and investors?

Interoperability allows companies to simultaneously comply with multiple reporting standards without having to invest additional human or financial resources. It thus serves as a guarantee of efficiency by limiting "double-reporting" as well as the costs associated with compliance.

In practice, interoperability represents a major challenge for companies subject to multiple jurisdictions (multinationals) but also for small and medium-sized enterprises (SMEs) that are part of a group of companies or choose voluntarily to comply with sustainability standards like the VSME standard.

It also allows companies that have already invested in drafting a non-financial report that complies with standards other than ESRS (GRI, CDP, etc.) to reuse the data collected for establishing their CSRD sustainability reporting.

Finally, companies that choose to "exploit" interoperability - meaning, to conform to various existing international standards - are often considered more credible by investors.

From the perspective of financial market participants, interoperability makes it easier to read sustainability reports and also facilitates the comparison of disclosed data.

What are the main ESG reporting standards concerned with interoperability?

ESRS standards (EFRAG)

Developed by EFRAG under the aegis of the European Commission, the ESRS standards (European Sustainability Reporting Standards) establish the framework and content to be respected for corporate sustainability reporting in accordance with the new CSRD directive.

The universal ESRS standards are based on the three classic pillars of CSR: environmental, social, and governance aspects (ESG criteria). They cover 12 topics in more detail, including one specifically dedicated to climate change (ESRS E1 standard).

In addition to these universal standards, applicable to all sectors, EFRAG is also working on the publication of sectorial standards for 40 specific sectors, which are expected to come into force in June 2026.

The ESRS standards mark an important step in the non-financial reporting of large companies and especially in the implementation of interoperability between existing standards.

Indeed, the CSRD directive explicitly states that these standards must take into account international standardization initiatives as far as possible in order to “contribute to the convergence of standards at the global level”. In other words, the CSRD provides a regulatory basis for the principle of interoperability between non-financial reporting standards for the first time.

One of the main objectives of the ESRS standards is precisely to harmonize the sustainability reporting framework within the EU to enable stakeholders (investors, regulators, the general public) to access clear, comprehensive, and comparable information.

The GRI Standards

The Global Reporting Initiative (GRI) is an independent, non-profit organization that developed the first global sustainability reporting standards in the 2000s. The GRI standards are considered the global “best practices” for sustainability reporting. They constitute the main ESG reporting framework used worldwide.

They consist of three types of standards:

- Universal Standards, which are intended for all companies wishing to implement a reporting approach.

- Sector-specific standards for four sectors considered as priorities: oil and gas / coal / agriculture, aquaculture, and fishing / mining. Two sector-specific standards are also being developed for financial services and textiles.

- Thematic standards, applicable only to companies concerned based on the results of their double materiality analysis.

💡Note: GRI standards remain a voluntary approach, which means companies are not obligated to comply with them when preparing their non-financial reporting.

The ISSB Standards

The International Sustainability Standards Board (ISSB) was created by the IFRS Foundation in 2021, with the aim of developing comprehensive and high-quality global baseline sustainability disclosure standards, focusing on the needs of investors and financial markets.

It is based on two main standards published in March 2023 and effective as of January 1, 2024:

- IFRS-S1 Standard on “sustainability-related financial information”: it requires companies to disclose all information about sustainability-related risks and opportunities that could affect their cash flows, the cost of capital, and access to financing.

- IFRS-S2 Standard on “climate-related disclosures”: it requires companies to disclose information on climate-related risks and opportunities that could affect their cash flows, the cost of capital, and access to financing.

💡Note: The standards developed by the ISSB are designated as “IFRS-S” to distinguish them from IFRS accounting standards developed by the IASB (International Accounting Standards Board) since 2005.

Like the IFRS standards, IFRS-S standards are voluntary standards unless countries require them to be mandatory for their companies. In practice, 143 countries have chosen to apply them, including 98% of European countries. This is notably the case in France.

The CDP Questionnaire

The Carbon Disclosure Project (CDP) is an international organization created in 2000 that manages a global reporting system for companies, cities, and regions through an annual questionnaire to assess their environmental impact.

Widely used by financial players as part of their investment strategy, the CDP questionnaire is based on a rating system aimed at evaluating the environmental performance of the organization. It includes three main questionnaires for companies:

- Climate Change

- Forests

- Water

To date, the CDP represents the largest and most comprehensive collection of data in the world on corporate environmental action. Companies that disclose environmental data through the CDP represent ⅔ of the world's market capitalization (!).

💡 Note: The approach is also voluntary but strongly recommended to demonstrate transparency and enhance the credibility of companies with investors.

Comparison between different ESG reporting standards

Scope

From the point of view of their scope, only the GRI standards and the ESRS standards currently address all three ESG themes: environment / social / governance.

The IFRS-S standards and the CDP questionnaire indeed focus solely on the environmental aspect.

However, note that the ISSB is currently working on standards also dedicated to the social and governance aspects.

Environmental Aspect

When we look more specifically at the environmental criterion, the ESRS standards and the GRI standards are the two most comprehensive frameworks, followed by the CDP questionnaire and finally the IFRS-S1 standard which focuses only on the climate issue.

Social Aspect

Regarding the social aspect, the GRI standards and the ESRS standards generally address similar themes, including:

- Social dialogue and collective bargaining

- Diversity within the company

- Social protection

- Health and safety of employees

- Training and skills development actions

- etc.

The main observable differences are however that:

- Unlike the GRI standards, the ESRS standards take into account the company's salary policy and equity

- Unlike the ESRS standards, the GRI standards take into account the impact of activities on local communities, the social assessment of suppliers, or the health and safety of consumers

Governance Aspect

Finally, in terms of governance, the GRI standards are more comprehensive than the ESRS standards. While the ESRS only addresses anti-corruption, lobbying, and procurement practices, the GRI standards add economic performance, marketing practices, and compliance with labels and anti-competitive behaviors.

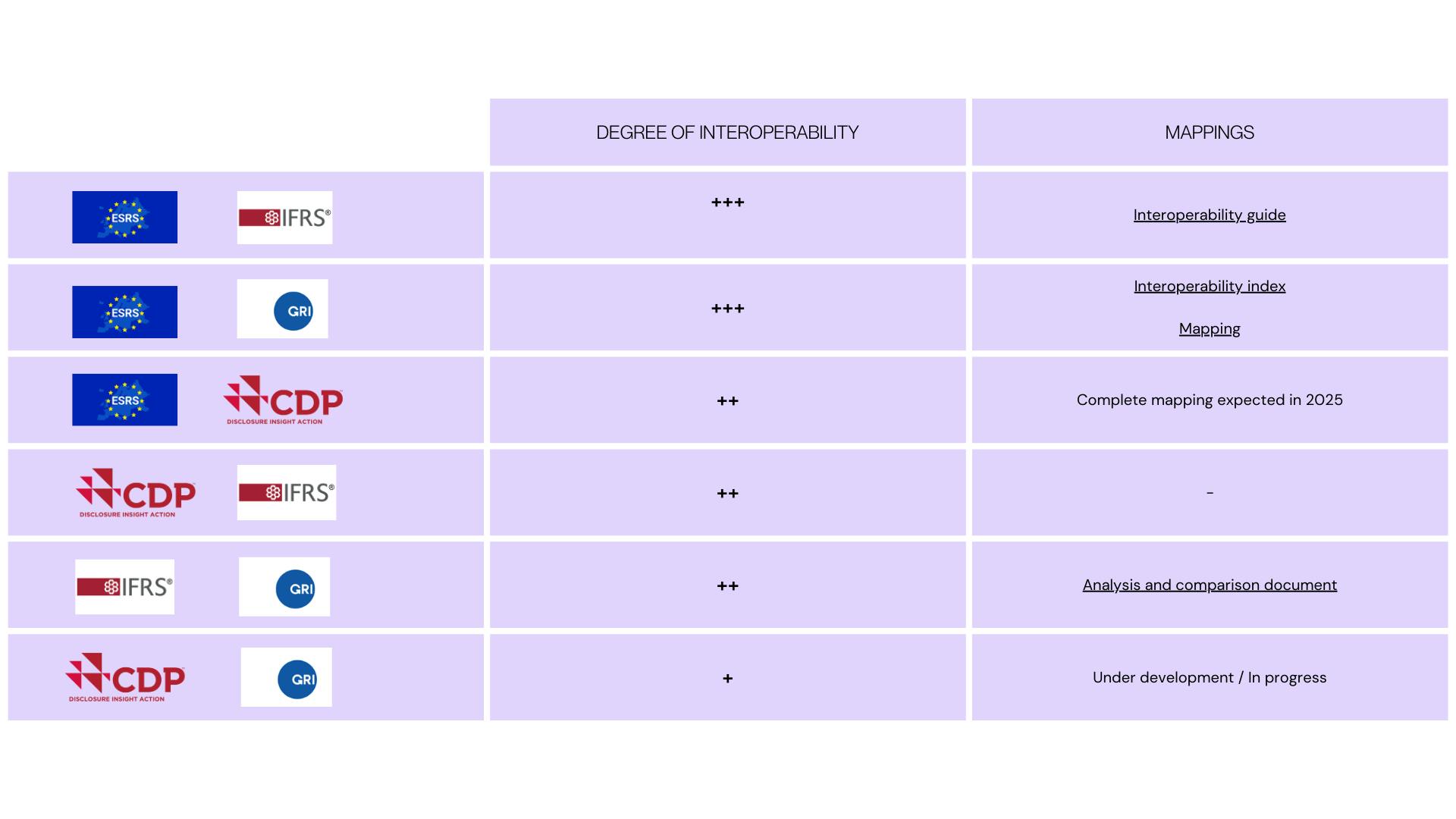

What degree of interoperability between the different ESG reporting standards?

In developing the ESRS standards, the EFRAG closely collaborated with other organizations (GRI, ISSB, CDP) to increase coherence and interoperability between different sustainability standards.

In practice, interoperability is formalized in the form of mapping which aligns the data collected within different standards. The aim is also, ultimately, to enable ESG reporting software to more quickly generate turnkey reports for different standards.

ESRS / CDP

On November 12, 2024, the EFRAG and the CDP announced the existence of significant interoperability and convergence between their reporting frameworks. This results from ongoing collaboration between the two organizations over many years.

A provisional mapping has been published, revealing a “substantial similarity” particularly between the CDP climate change questionnaire and the ESRS E1 standard. A full mapping must be published before the start of the CDP 2025 disclosure cycle.

This mapping is particularly intended to allow:

- Companies reporting in accordance with the ESRS E1 standard to more easily complete the CDP climate change questionnaire

- Companies reporting through the CDP to be well-prepared for the ESRS E1 disclosure requirements.

This is therefore not a complete interoperability. However, the CDP has specified that it will consider enhancing the alignment of the questionnaire with the ESRS E1 in 2025.

ESRS / GRI

The GRI closely collaborated with the EFRAG in preparing the ESRS standards to also promote a high level of alignment between the two reporting systems.

This collaboration resulted in the publication of a first version of the GRI-ESRS Interoperability Index on November 30, 2023. This document was supplemented on December 21, 2023 by the ESRS-GRI Standards Datapoint Mapping, a mapping that identifies the corresponding data point in the GRI standards for each ESRS disclosure requirement.

These documents enable interested companies to understand the commonalities between the two reporting standards.

Furthermore, the GRI specified that entities publishing a sustainability report under the ESRS will be considered as “referring” to the GRI standards. Conversely, GRI reporters can benefit from their current reporting efforts to prepare their sustainability reporting in accordance with the ESRS standards.

ESRS / ISSB

EFRAG and ISSB have also collaborated to ensure interoperability between ESRS and IFRS-S standards. This collaboration resulted in the publication by IFRS on May 2, 2024, of an interoperability guide that demonstrates a “high level of alignment” between ESRS and IFRS-S standards.

This document provides practical assistance explaining to companies how they can effectively comply with both sets of standards. The goal is to reduce complexity, fragmentation, and duplication for companies that apply both ISSB and ESRS standards.

GRI / ISSB

In 2022, GRI and ISSB began collaborating to ensure the compatibility and interoperability of sustainability information under both series of standards.

On January 18, 2024, the two organizations published an analysis and comparison document which particularly highlights interoperability between GRI 305 (Emissions) standard and IFRS-S2 standard. According to the IFRS press release, the requirements of these two standards demonstrate “a high degree of alignment”, particularly because they are both based on the GHG Protocol.

IFRS indicated that companies that already disclose their Scope 1, 2, and 3 greenhouse gas emissions in accordance with GRI 305 standard are “well-positioned” to communicate emissions information according to IFRS-S2 standard.

The two organizations also announced on May 24, 2025, that they are committed to jointly identifying and aligning common information for the development of future thematic and sectoral standards.

GRI / CDP

GRI and CDP are working together to harmonize their reporting frameworks and avoid duplication of disclosure requirements. This partnership was strengthened through a memorandum of understanding signed during COP 29. The two organizations announced that mapping exercises would be conducted to align the CDP questionnaire with GRI’s thematic standards.

CDP / ISSB

The CDP climate change questionnaire complies with the IFRS-S2 standard of the ISSB. Thus, CDP is an effective tool to help companies comply with the IFRS-S2 standard.

Conclusion

For several years, and particularly in the context of developing ESRS standards, international standardization bodies have been working to ensure a high level of interoperability between their different standards. The goal is to enhance clarity and efficiency in ESG reporting and also to allow companies to benefit from this interoperability in the face of more demanding investors.

If differences remain, the majority of international ESG reporting standards today ensure a high level of convergence in their disclosure requirements, which is likely to be further accentuated in the coming years thanks to the many existing initiatives.

Our latest articles

Responsible Digital: the next step after your Carbon Footprint assessment

Understand the importance of implementing a responsible digital approach after completing your carbon footprint assessment

CSR News - April 2025

Discover the key developments: ongoing projects, standards updates, new official documents.

ESG Data: How to identify, collect, and use them

Learn how to structure your ESG data to better drive your commitments and enhance your sustainable performance

Guide on ESG performance: definition, measurement, and impact on business

ESG performance, a driving force for responsible growth: follow our guide to understand everything in just a few minutes