25 Questions on CSRD or ESG Reporting

What is a "reasonable" effort? On which ESRS should a company report? Greenscope answers your questions!

1. What is the CSRD?

The "CSRD" Directive, which stands for "Corporate Sustainability Reporting Directive," is a European directive with the primary objectives of harmonizing the disclosure of environmental, social, and governance (ESG) information by companies, and improving the availability & quality of sustainability data published through a more precise framing of companies' non-financial reports.

The CSRD also aims to direct investment flows toward sustainable companies and is part of the European Green Deal, which aims for carbon neutrality of the continent by 2050.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

2. What does the CSRD change compared to DPEF (and NFRD)?

For several years, European legislation has required companies to publicly share information on how they operate and respond to ESG issues. Until the adoption of the CSRD in 2022, these reports were governed by the "Non-Financial Reporting Directive" (NFRD), transposed into French law under the name "DPEF", short for "Non-Financial Performance Statement".

The DPEF outlined the company's business model, analysis of its main CSR risks, due diligence policies and procedures, and the outcomes of the policies supported by performance indicators. However, the reports produced to meet the NFRD - including the DPEF, a report required by the transposition of the NFRD into French law - showed several major shortcomings: significant omissions of information and a lack of comparability and reliability of the statements. The scope of the NFRD was also more limited with 11,700 companies affected.

For French companies, the CSRD report is therefore a more advanced DPEF, following a standardized framework at the European level and relying on a common method for determining the company's ESG issues, the analysis of double materiality.

The CSRD significantly extends the number of companies targeted - nearly 50,000 companies headquartered in an EU member country will have to report - and provides them with a common and comparable framework for their non-financial reporting exercise. This framework will meet the information needs of stakeholders such as financial actors, who are themselves subject to ESG reporting obligations, and will promote the development of a knowledge base at the European level. The objective: to better analyze international progress, and to more precisely adjust upcoming regulations and directives.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

3. What are the links between the CSRD and other European Green Deal regulations?

The CSRD represents a true deepening of requirements for non-financial performance reporting. It creates a coherent reporting framework in which other European regulations and sustainability reporting requirements, such as taxonomy, CSDDD, or greenhouse gas emissions balances, can be easily integrated.

The European environmental taxonomy, which is part of the Green Deal and classifies economic activities based on their sustainability, is notably integrated within the CSRD.

The final sustainability report must therefore integrate the information required in Article 8 of Regulation (EU) 2020/852 on the European taxonomy (see Annex D of Regulation 2023/2772 on the CSRD).

The CSDDD, adopted after the CSRD, also refers to the CSRD. Thus, to avoid the multiplication of reporting obligations, the CSDDD regulation provides that the disclosure of information related to CSDDD requirements must be made within the same sustainability report as the CSRD.

In France, the BEGES exercise (Greenhouse Gas Emissions Inventory), mandatory every 4 years for companies with more than 500 employees in the mainland and 250 employees overseas, will help meet some of the information required for CSRD reporting, notably for ESRS E1 (Climate).

📄 Sources :

4. Which companies are affected, and when will they be?

As a reminder, the NFRD applied to large companies when their turnover and staff exceeded the following thresholds:

- Listed companies: more than 500 employees and €20M in balance sheet or €40M in turnover

- Unlisted companies: more than 500 employees and €100M in balance sheet or €100M in turnover

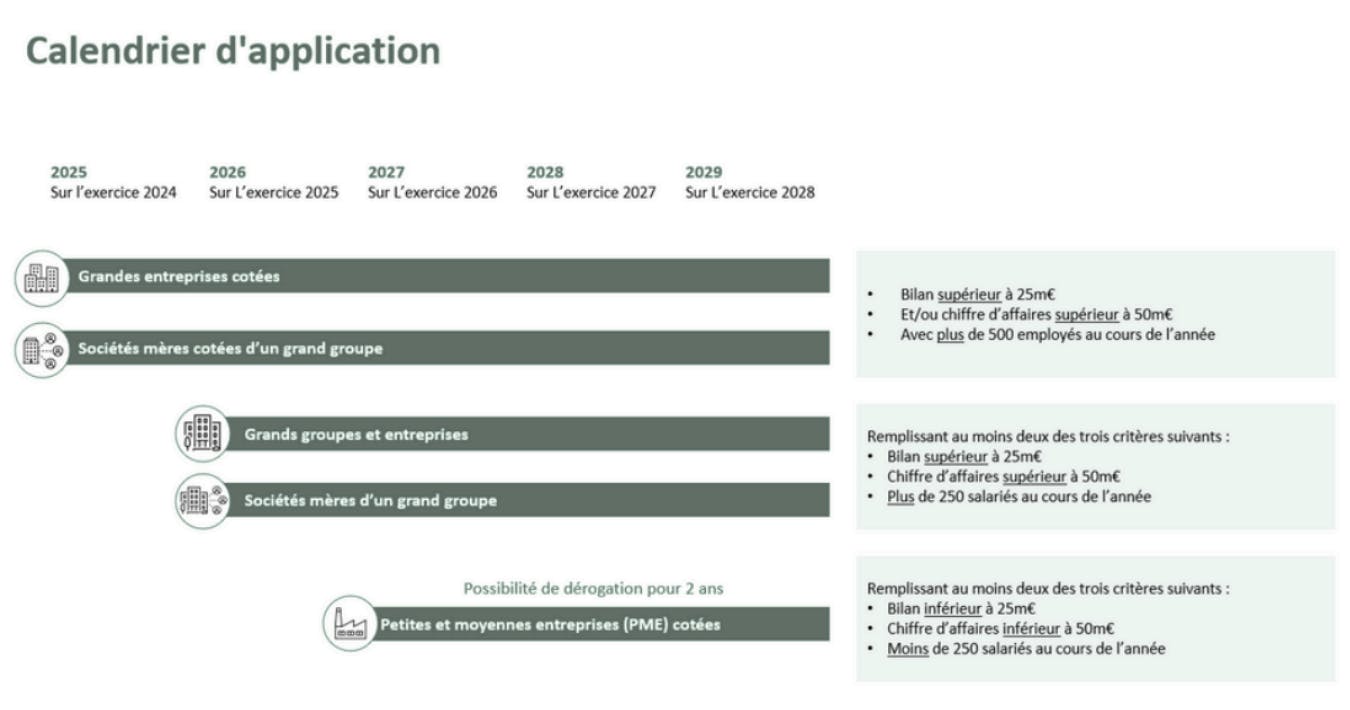

The CSRD provides for a gradual implementation of reporting obligations:

- The first companies affected are those that were subject to the NFRD. They will have to publish their report in 2025 on the 2024 fiscal year: these are the listed companies with more than 500 employees.

- Other large European companies, unlisted and meeting 2 of the following 3 criteria - more than 250 employees, more than €50M in turnover, and more than €25M in balance sheet - will have to carry out their CSRD reporting on the 2025 fiscal year with a publication in 2026.

- For listed SMEs (except micro-enterprises), the publication of the report is scheduled for 2027 on the 2026 financial year, with simplified standards and an option for a 2-year deferral.

- Finally, large non-European companies with more than €150M in revenue having a subsidiary or branch based in the European Union will have to report on the 2028 fiscal year.

Find out if my company is subject to the CSRD: check your obligations in 30 seconds on the French government's CSR Portal

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

5. Are non-listed SMEs concerned by the CSRD?

Non-listed SMEs are not directly subject to the CSRD on a mandatory basis. However, within the framework of data collection from other companies subject to the CSRD that are part of their value chain or to access financing, for example, it is quite possible that they will have to report certain indicators of the standard.

At the beginning of 2024, the EFRAG published a first version of voluntary reporting standards for non-listed SMEs, for public consultation, called VSME (Voluntary Sustainability Reporting Standard for non-listed SMEs). These VSMEs include several modules, for which conducting a prior double materiality analysis is not mandatory: a basic module, which corresponds to a simplified version of ESRS E1 to G1, and a complementary module, including notably a narrative part (strategy, business model, value chain, etc.) and information on scope 3 GHG emissions, gender diversity, or even income derived from controversial sectors.

In the future, SMEs capable of providing accurate and standardized information on their environmental impact and their impact on human rights could benefit from a real competitive advantage.

📄 Sources :

6. What is double materiality analysis?

Materiality analysis is a process of identifying and prioritizing the most significant ESG issues for a company and its stakeholders. The concept of double materiality corresponds to the analysis of two types of materiality: financial materiality, from the environment on the company, known as outside-in, and impact materiality, from the company on its environment, known as inside-out.

- Financial Materiality: This involves identifying the opportunities and risks generated by the economic and social environment that most affect the company's financial performance. These impacts are measured based on two criteria: the probability of occurrence, and the magnitude, which is the extent of the risk or opportunity across the entire value chain and time frames.

- Impact Materiality: This involves taking into account the negative or positive impacts of the company on its economic and social environment, corresponding to ESG issues. These effects are evaluated based on four criteria: the scope, which aims to assess the extent of the impact in terms of geography and population, the magnitude, which reflects the severity of the repercussion, irreversibility, concerning the ability to remedy the impact (only for negative impacts), and the probability of occurrence for potential impacts.

The analysis of double materiality makes it possible to determine the indicators called “material” for the company, which must be covered and published during CSRD reporting.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

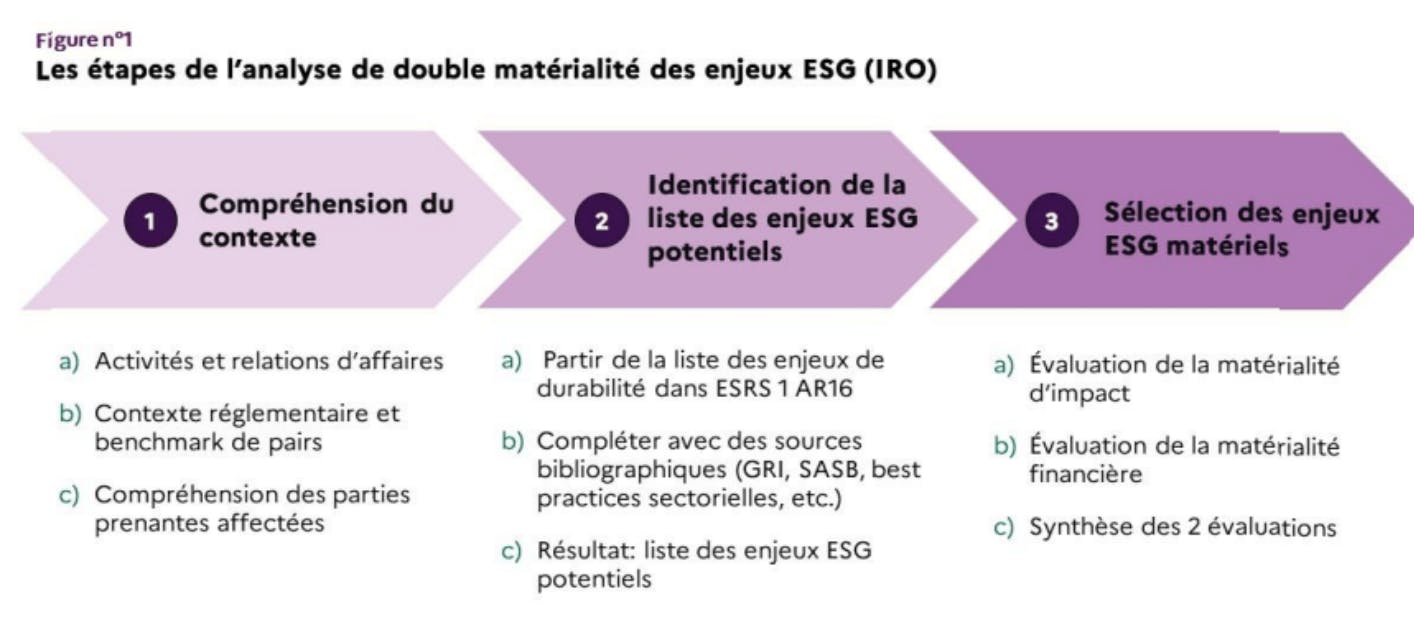

7. What are the steps in the double materiality analysis?

The EFRAG recommends a three-step approach for companies, followed by the reporting exercise. This approach is summarized below (Guide “Deploying the ESRS: A Management Tool for the Transition”, Accounting Standards Authority, December 2023):

📄 Sources :

- Guide from the Accounting Standards Authority, “Deploying the ESRS: A Tool for the Transition” (December 2023)

- EFRAG Guide on Double Materiality Analysis (in English, May 2024)

8. What is gap analysis?

Following the identification of material issues for the company and the associated indicators, it is necessary to describe the data to be collected and the collection process, in preparation for the audit phases.

A “gap analysis” is then carried out by identifying the gap between the information available today and the reporting obligations. This aims to map the data sources and assess the maturity level of the data compared to the expected ESRS indicators. It thus allows prioritizing the preparation of relevant information for reporting. Indeed, the regulator does not expect the CSRD reporting to be done on all data points but on those that are material for the organization. If certain material data points are not available, efforts will be made to gather them to improve reporting from one year to the next.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

9. How to determine the reporting period?

The reporting period considered is the same as that of the company's financial statements. However, as specified by the Directorate General for Enterprises, certain information may come from different periods, provided this does not alter their comparability over time, nor with other companies. Therefore, a company that uses data from other periods must first ensure that no event likely to alter this data has occurred since.

📄 Source :

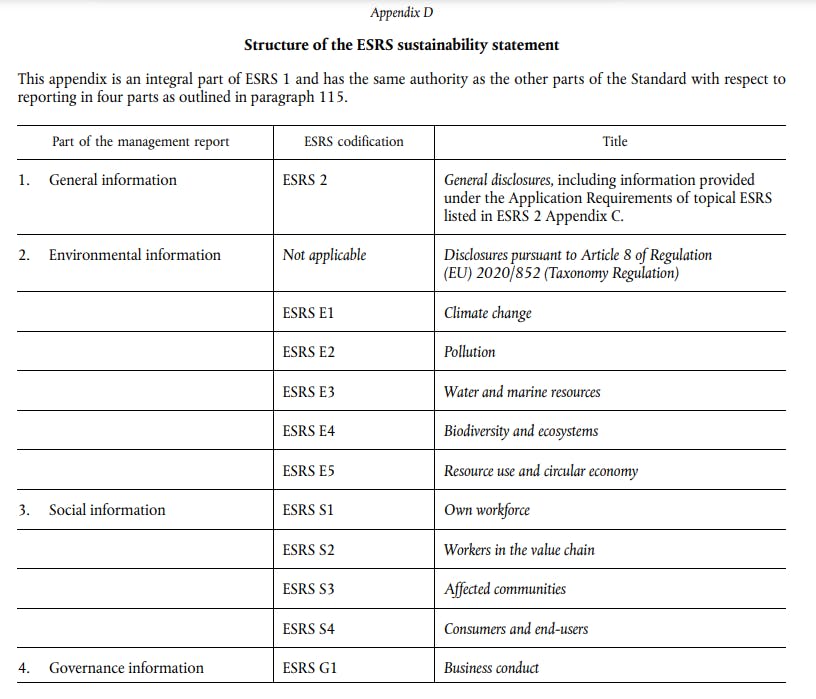

10. What are the different ESRS?

The ESRS, or European Sustainability Reporting Standards, are the reporting criteria created by the CSRD. There are 12 of them, and they cover the 3 ESG themes: Environment, Social, and Governance.

- General ESRS: ESRS 1 and ESRS 2

- Environmental ESRS: ESRS E1, E2, E3, E4, E4, E5

- Social ESRS: ESRS S1, S2, S3, S4

- Governance ESRS: ESRS G1

The ESRS are a tool for steering companies towards sustainable business models and an instrument of transparency.

They are broken down into DR ("Disclosure Requirements"), which detail the categories of data to be collected. These categories are themselves divided into data points, totaling 1,200 for all ESRS. The number of DRs and, subsequently, the data points on which a company must report is determined by its double materiality analysis.

11. What are the sectoral ESRS (ESRS SEC)?

As of 2027, companies will need to publish additional sector-specific information not covered or incompletely addressed by the all-sectors ESRS.

These additional pieces of information will soon be detailed in sectoral ESRS standards called "ESRS SEC." These will also include additional data points to be disclosed in the all-sectors ESRS category.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

12. On which ESRS must a company report?

Among the 12 all-sectors ESRS, the only mandatory one is ESRS 2 "General Disclosures", as specified in the delegated act of the European Commission adopted on July 31, 2023.

It is the material issues chosen during the double materiality analysis that will then determine the choice of ESRS on which the company will have to report. However, ESRS E1 "Climate Change" is specific; refer to question 14 for more information.

When the sectoral ESRS become available, companies will need to complement their reporting on the 12 all-sectors ESRS with the sectoral standards corresponding to their business sector, starting from fiscal year 2027. Until their availability, companies are required to supplement the all-sectors ESRS with entity-specific information.

📄 Sources :

13. What are the Minimum Disclosure Requirements (MDR)?

The Minimum Disclosure Requirements, or MDR, are detailed in ESRS 2 "General Disclosures." They outline a minimum amount of information that must be provided by the company on four themes:

- The company's sustainability policies (MDR-P, for "Policies")

- The actions and resources put in place and planned (MDR-A, for "Actions")

- The targets to be achieved (MDR-T, for "Targets")

- The indicators (MDR-M, for "Metrics")

These disclosure requirements, which apply to all material thematic issues, are intended to avoid potential repetitions in environmental, social, or governance ESRS.

It’s important to note that the goal of the reporting required by the CSRD is not to judge the quality or effectiveness of the policies, actions, targets, and indicators implemented by the company: the ESRS only require transparency. If a company has not implemented such elements for an issue previously determined as material, it must clearly state it in its report.

📄 Source :

14. Is ESRS E1 mandatory?

The ESRS E1 "Climate Change" has a specificity compared to other sector-wide ESRS: it is the only one for which the burden of proof is reversed for the company. In practice, any company that chooses, following its double materiality analysis, not to report on this ESRS must therefore prove that climate change is not a material issue for its activity.

However, almost all, if not all, human activities emit greenhouse gases and thus impact climate change. The same logic applies to the material impact of climate change on businesses: nearly all, or almost all, should be affected by climate change. The ESRS E1 is therefore de facto almost mandatory for companies.

According to the ANC (Accounting Standards Authority), to justify that the consequences of climate change on the company are not material, the company should have conducted a risk analysis (physical and transition-related) demonstrating that its assets, products or services would not be significantly exposed in a scenario of limiting global warming to 1.5°C, as well as in a high emissions scenario.

Also according to the ANC, to justify that its contribution to climate change is not material, a company should demonstrate that the order of magnitude of its GHG emissions is negligible. The choice of magnitudes must be made according to the activities and specifics of the company.

📄 Sources :

15. What is a "reasonable" effort in data collection?

ESRS 1 indicates that companies must make a "reasonable" effort to collect data relating to their value chain, and if unable to obtain this data, they may use estimates.

The European Commission clarified this notion of reasonable effort in its FAQ published in the summer of 2024. The reasonableness of information collection depends on:

- The relationship between the size and resources of the company in relation to the scale and complexity of its value chain, in a spirit of proportionality

- The maturity of the company and all the actors in its value chain on ESG topics. The European Commission emphasizes the need for this maturity to progress over the years.

- The availability of effective and accessible tools, particularly digital ones, allowing information sharing within the value chain

📄 Sources :

- FAQ of the European Commission (August 2024)

- Guide of the Directorate-General for Enterprises “CSRD? Steering my company's transition” (November 2024)

16. Will I need to consult my suppliers for my reporting?

The number of quantitative information concerning the value chain is relatively small, and the CSRD does not require systematic data collection from actors in the value chain (upstream and downstream).

The notion of “reasonable effort” applies here: companies are allowed to use estimates if they cannot obtain the requested information, but only after making "reasonable efforts" to do so.

The central challenge for the company is to select the key stakeholders: it is they who, through their expertise or ability to communicate data to the company, will help to qualify the materiality of an issue or provide better quality data than estimates the company could make.

📄 Source :

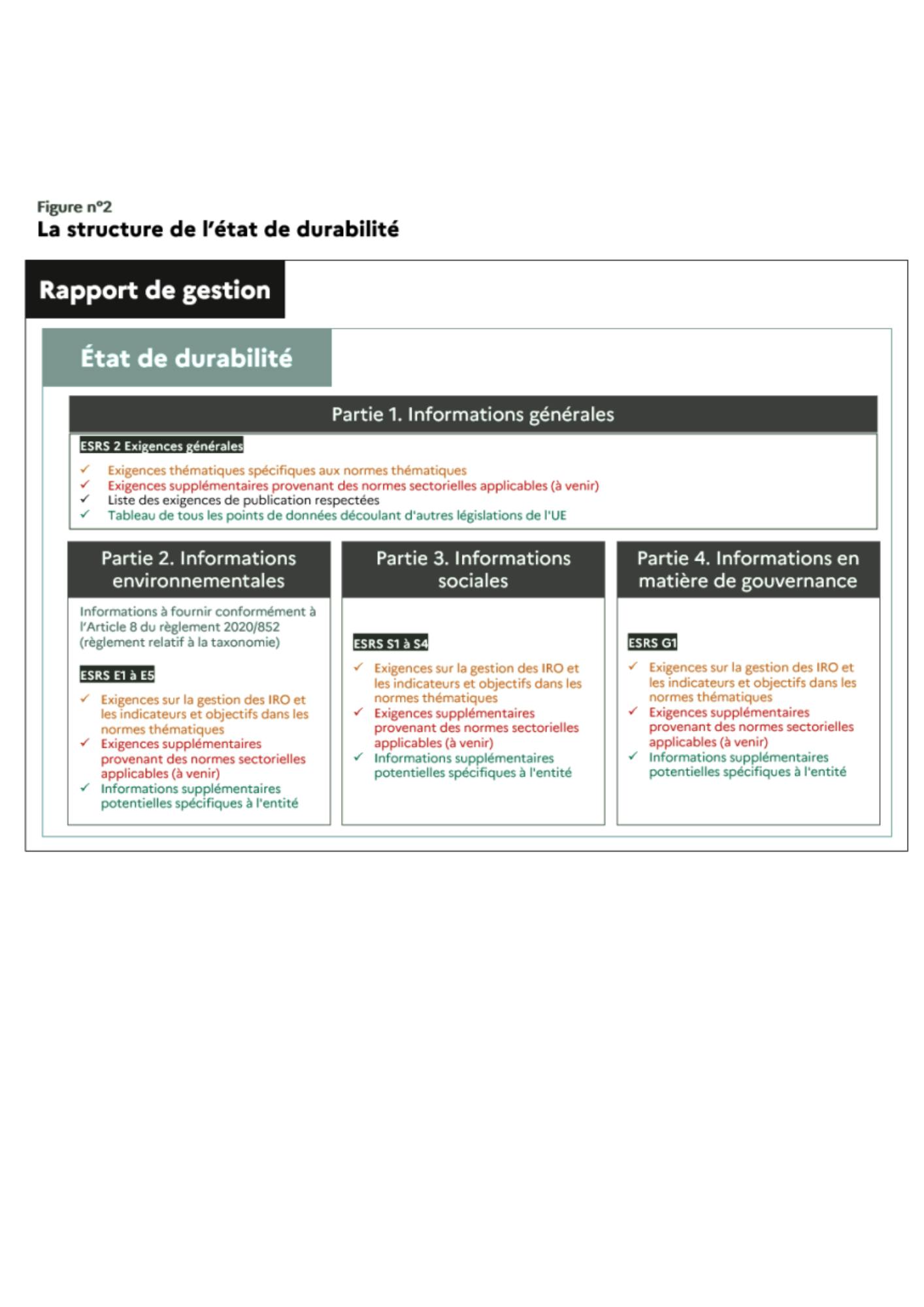

17. What is the expected publication format?

The reporting required by the CSRD must be presented in a specific section of the company's management report, and its structure is specified in Appendix D of the ESRS 1.

It is divided into several parts:

- General Information: ESRS 2

- Environmental Information: ESRS E1 to E5

- Social Information: ESRS S1 to S4

- Governance Information: ESRS G1

The management report must be published in a unique electronic format across Europe, the xHTML format. Tags should be defined in a digital taxonomy (set by delegated act), and must eventually be inserted into this digital format.

📄 Sources:

18. Who should the CSRD report be submitted to?

In France, sustainability information must appear in a separate section of the company's management report, and its potential filing at the commercial court registry is therefore simultaneous with that of the management report.

In the long term, the publication of sustainability data will be part of the European digital platform project European Single Access Point (ESAP) which is expected to aggregate the financial and non-financial data of European companies from 2027 onwards. ESAP will thus facilitate direct and centralized access to information on companies and will gradually integrate all of European companies' public information according to a schedule spanning from 2026 to 2030. The CSRD data must be published there from July 10, 2028.

📄 Sources:

- "ESAP, the future single European access point for public company information", Entreprendre.Service-Public website

- "ESAP, the single European access point for financial and non-financial information of European entities, begins its implementation", AMF article (February 2024)

19. What points will need to be audited? By whom?

The audit requirements are provided by the laws transposing the CSRD into French law.

In France, the report will be audited by a statutory auditor or an independent third-party body (OTI), which must be accredited by COFRAC. The OTIs will also be subject to the same rules as the statutory auditors, particularly concerning appointment, ethics, mission performance, or dismissal. The choice of auditor is at the discretion of the company. All auditors will be supervised by the High Authority for Audit (H2A), which replaces the High Council for Statutory Auditors (H3C). Additionally, it is reinforced by professionals skilled in sustainability. In fact, in October 2024, H2A published its guidelines on the certification of published information.

The certification mission must verify compliance with the ESRS of the double materiality analysis and published information, as well as the compliance of information tagging (XBRL format).

For more information on H2A's recommendations, see our dedicated article “CSRD Sustainability Audit: What to Take Away from H2A's Guidelines?”.

20. Are the CSRD criteria compatible with other sets of standards?

The interoperability between the CSRD and other normative frameworks is a major issue in ESG reporting, in order to reduce the phenomenon of double reporting for companies that are already part of an existing normative framework.

The ISSB notably published in May 2024 a guide to interoperability between its own standards and the ESRS. Thus, the definition of financial materiality used in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is aligned with that used in the ESRS. On climate issues, the two sets of standards are also relatively aligned: the ISSB thus provides a correspondence table between IFRS standards and ESRS 1, 2, and E1. In its guide, the ISSB makes several recommendations to companies to facilitate their navigation from one normative framework to another.

In November 2024, the CDP and the EFRAG announced the release in early 2025 of a mapping of the interoperability between CDP standards and ESRS E1.

Finally, the GRI and the EFRAG have published an interoperability index between these two reporting frameworks, and entities that have completed their CSRD reporting are considered to have completed their GRI reporting "in reference" to these standards. View the GRI/CSRD Operability Index.

📄 Sources :

- Interoperability Guide between ISSB and CSRD Standards (May 2024)

- Interoperability Index between GRI and CSRD (November 2023)

- Press Release on Interoperability between CDP and CSRD (November 2024)

21. What are the various reporting reliefs or exemptions?

Certain companies are currently exempt from reporting: micro-enterprises (fewer than 10 employees and annual turnover of less than 2 million euros), small non-listed companies (fewer than 50 employees and annual turnover of less than 10 million euros), non-profit organizations, and public entities. SMEs listed on stock exchanges can postpone the first reporting exercise to 2028 (instead of 2026), but must justify the absence of a sustainability report in their management report.

Furthermore, a major exemption concerns groups with subsidiaries: if the group publishes consolidated accounts, the CSRD application thresholds are considered at the group level. Consequently, reporting must also be done at the parent company level, and subsidiaries can be exempted from reporting, except for those considered large listed companies (according to the CSRD). The subsidiary(ies) must, however, communicate an exemption declaration and clearly indicate the name and registered office of the parent company, as well as the link to its consolidated management report.

22. What are the penalties if the CSRD is not properly implemented by a company?

The reporting exercise required by the CSRD, its communication, and audit are mandatory, and non-compliance or improper application of the CSRD will result in legal and financial penalties, not to mention the reputational risks the company may face.

Note: the Commercial Code provides for the possibility of making public the sanctions imposed on a company, which increases the reputational risk.

Therefore, a company that has not collected or published its data may be excluded from a public tender or may not have its concession contract renewed. It may also be compelled by a summary court judgment to communicate its sustainability information. It is also subject to administrative fines of up to 150,000 euros.

The executives of a company failing to meet CSRD obligations may also be personally sanctioned, with fines of up to 75,000 euros.

📄 Source :

23. How to go further by defining a CSRD roadmap?

Enrich a little your answer there? CSRD action/transition plans can be of various types:

- Those related to the material data points that the company should collect but on which it must structure its internal data search

- Action plans to be deployed depending on the reported data on the various indicators ⇒ if the ESG performance is weak, what actions to take to remedy this (take the opportunity to say that at Greenscope we offer benchmarking to compare with peers)

- Actions also throughout the value chain to make its suppliers, customers, etc. accountable.

And that all these actions must be guided by/in line with a clear directive carried by governance... see our white paper.

The reporting exercise required by the CSRD calls for the definition of a precise roadmap and action plans to meet the various obligations. These action plans can address a need for structuring the internal data point collection, but can also aim at deploying actions to enhance the company's ESG performance. Finally, they can also aim at deploying actions to empower the company's suppliers or customers.

We therefore recommend, in order to effectively manage this roadmap, to define an adapted governance, responsible for monitoring and improving the indicators used within the framework of the CSRD, to establish internal data collection processes, and to empower those directly responsible for the collection.

For more information, download our white paper “ESG Governance: How to Align Stakeholder Interests?”

Finally, let us note that anticipation should not be the sole preserve of companies first subject to the regulation. Light measures are planned for the first years of ESRS application, but the AMF thus calls on companies to use this additional time to reflect on the subsequent implementation of complete reporting obligations, and above all to anticipate the adaptation of their data collection and production systems from today.

📄 Source : “The Ultimate Guide to CSRD”, Greenscope

24. Resources and Useful Links

European directives and regulations:

- CSRD: Delegated Regulation (EU) 2023/2772

- Taxonomy: Regulation (EU) 2020/852

- CSDDD: Directive (EU) 2024/1760

FAQs:

- FAQ of the European Commission (August 2024)

- FAQ of the EFRAG (July 2024)

Institutional reports and guides:

- Guide from the Accounting Standards Authority, “Deploying the ESRS: a tool for the transition” (December 2023)

- Guide from the Directorate General for Enterprise “CSRD? Managing the transition of my business” (November 2024)

- Guide from the Chamber of Commerce and Industry “The CSRD directive, a new framework for extra-financial reporting” (April 2023)

Resources produced by standard-setting organizations (ISSB, GRI…):

- Interoperability guide between ISSB standards and CSRD (May 2024)

- Interoperability index between GRI and CSRD (November 2023)

- Press release on interoperability between CDP and CSRD (November 2024)

Articles:

- “CSRD sustainability reporting: preparing for new obligations”, AMF (February 2024)

- Non-financial reporting standards: how to find your way?, Sami (updated in December 2024)

25. Bonus: our CSRD glossary

- CSRD: Corporate Sustainability Reporting Directive

- ESRS: European Sustainability Reporting Standards

- DPEF: Statement of Extra-Financial Performance

- EFRAG: European Financial Reporting Advisory Group

- ESRS: European Sustainability Reporting Standards IRO: impacts, risks, opportunities

- NFRD: Non-Financial Reporting Directive

- CSDDD: Corporate Sustainability Due Diligence Directive

- SBTi: Science Based Targets Initiative

- ISSB: International Sustainability Standards Board

- Governance: the way an organization structures, governs, and conducts its operations to achieve its various objectives, establishing rules, practices, hierarchies, while ensuring decision-making and the execution of these decisions

- Reporting period: the period to which the data used for reporting belongs. In general, year n reporting is done on data from the previous year, n-1.

Conclusion

Navigating CSRD requirements can be complex, but it is also a unique opportunity to structure your ESG data and accelerate your sustainable transition. Our experts guide you step by step to make your reporting a strategic asset. Schedule an appointment now!

Our latest articles

CSR News - December 2025

Discover key developments: ongoing projects, standards updates, new official documents.

EDCI - Understanding the ESG Data Convergence Initiative to harmonize ESG reporting in Private Equity

Simplify and standardize your ESG data with EDCI.

Understanding SFDR: The European ESG transparency framework made simple

Understanding SFDR means understanding what structures sustainable finance in Europe. Requirements, tools, impacts: let's break it down.

CSR News - November 2025

Discover key developments: ongoing projects, standards updates, new official documents.